The ODFC Profile

The Okinawa Development Finance Corporation (ODFC) is a government-affiliated financial institution that provides policy-based finance in a centralized and comprehensive manner.

Establishment

On May 15, 1972, when Okinawa was returned to Japan, the ODFC was established under “the Okinawa Development Finance Corporation Law” with the purpose of providing policy-based finance in Okinawa in a centralized and comprehensive manner.

Purpose

For the purpose of promoting the development of industries in Okinawa, the ODFC provides long-term funds to complement or encourage private financial institutions’ financing and private investment. In addition, the ODFC is intended to contribute to the promotion of the economy and society of Okinawa by providing funds to Okinawan people to whom funds are not adequately supplied by private financial institutions, including persons who need housing, those who are engaged in agriculture, forestry, or fisheries, those who manage medium and small-sized companies, those who plan to establish a hospital or other medical facilities, environmental health related business operators, etc.

[Okinawa Development Finance Corporation Law (Act No.31 of May 13, 1972) Article 1]

Capital

75.8 billion yen (as of Mar. 31, 2015)

The ODFC is wholly owned by the Japanese Government.

Number of Directors and Employees

Director : 5, Employee : 211 (budgetary fixed number for FY2015)

Number of Branches

6 branches

Agencies

11 financial institutions, 255 locations (as of Mar. 31, 2015)

Overview of Operations

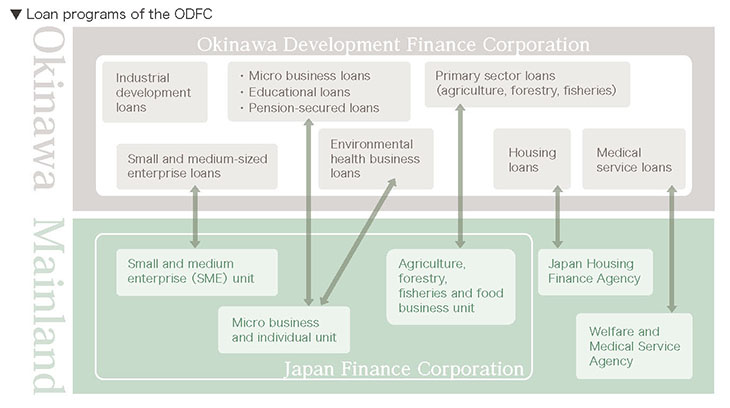

As a region-specific comprehensive policy-based financial institution, the ODFC offers services equivalent to the services provided by the Japan Finance Corporation, the Japan Housing Finance Agency, and the Welfare and Medical Service Agency (excluding social welfare loans) on the mainland, as well as a unique system that responds to regional political issues, investment for regional development or business revitalization, and venture investment in an integrated fashion.

1. Loan programs

Providing industrial development loans, small and medium-sized enterprise loans, micro business loans, educational loans, pension-secured loans, housing loans, primary sector loans (agriculture, forestry, fisheries), medical service loans, and environmental health business loans.

2. Acquisition of corporate bonds

Acquiring corporate bonds issued to raise long-term funds needed for businesses that contribute to the promotion and development of industries in Okinawa or needed to promote the business of small and medium –sized enterprises operating in Okinawa.

3. Guarantee of liabilities

Guarantee of debts for long-term funds needed for businesses that contribute to the promotion and development of industries in Okinawa.

4. Assignment of claims

Acquiring loan claims for long-term funds needed for businesses that contribute to the promotion and development of industries in Okinawa.

5. Investments

Investing funds needed for businesses that contribute to the promotion and development of industries in Okinawa.

6. Investments for the creation of new businesses

Investing funds needed for businesses that promote the creation of new business in Okinawa and contribute to the promotion of industries in Okinawa.

7. Debt equity swap

Swapping loans held by an enterprise that is distressed but could be revitalized for equities(DES)(limited to loans for small and medium- sized enterprises, micro businesses, agriculture, forestry and fisheries, environmental health).8. Agency Services

Being entrusted with the securitization support business of the Japan Housing Finance Agency, the review and collection business of the Organization for Workers’ Retirement Allowance Mutual Aid, and the loan claim management and collection business of the former Government Pension Investment Fund in the Welfare and Medical Service Agency.